In the world of finance and investing, the Market Cap-to-GDP ratio—often referred to as the Buffett Indicator—is a tool that can give us insights into the overall health of an economy. While it’s been popularized by billionaire investor Warren Buffett, it’s not just reserved for Wall Street. For emerging markets like India, this ratio can provide valuable insights into whether the economy is under or overvalued.

So, what exactly does the Market Cap-to-GDP ratio tell us about India’s economy, and how does it compare to Buffett’s global framework? Let’s break it down.

What is the Market Cap-to-GDP Ratio?

The Market Cap-to-GDP ratio compares a country’s total stock market capitalization (the total value of all publicly traded companies) to its Gross Domestic Product (GDP). In simple terms, it measures the size of a country’s stock market relative to the size of its economy.

Formula:

Market Capitalization of Listed Companies / GDP of the country

If the ratio is high, it could mean that the stock market is overvalued relative to the economy. Conversely, a low ratio could indicate that the stock market is undervalued or that the economy is larger than the stock market.

The Buffett Indicator: A Snapshot of Valuation

Warren Buffett, one of the world’s most respected investors, has often referred to the Market Cap-to-GDP ratio as a gauge of the overall market’s valuation. In fact, Buffett has called it “probably the best single measure of where valuations stand at any given moment.”

Buffett’s view on the indicator is simple:

- If the ratio is above 100%, it suggests that the stock market is overvalued relative to the country’s economy.

- If it’s below 50%, it suggests that the stock market may be undervalued, indicating potential for growth.

While this ratio is useful, it’s important to remember that it’s just one measure in a sea of economic indicators. Let’s now apply this thinking to India.

India’s Market Cap-to-GDP Ratio: What Does It Show?

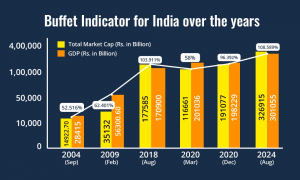

As of 2024, India’s Market Cap-to-GDP ratio stands at approximately 115%, according to data from Bloomberg and the Reserve Bank of India (RBI). This suggests that India’s stock market is slightly overvalued relative to its overall economic size, reflecting investor confidence in the country’s growth potential.

Here are some insights that can be drawn from India’s current ratio:

- Market Capitalization and Growth Potential:

India has one of the world’s fastest-growing economies, and its stock market reflects that potential. The BSE Sensex and NSE Nifty 50 indices have seen considerable growth, driven by domestic consumption, the tech boom, and increasing foreign investment. A ratio around 115% indicates that the market is likely factoring in the optimistic growth expectations for the future.

- Investor Sentiment and Valuation:

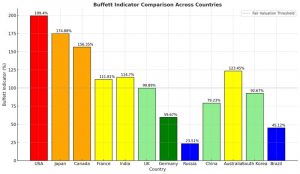

A ratio above 100% suggests that the market might be slightly overvalued, but it is also a reflection of the positive sentiment surrounding India’s economic growth, particularly in sectors such as technology, renewable energy, and consumer goods. The market’s valuation may be justified if these growth drivers continue to deliver results. However, if the ratio rises much higher, it could signal a potential correction. - Comparing with Developed Economies:

When comparing India’s Market Cap-to-GDP ratio to those of developed economies like the U.S., which often sees ratios above 150%, India’s ratio of 105% indicates that its stock market, while growing, is still relatively more grounded in terms of its overall size compared to the economy. This signals potential for further capital mobilization and investment in the coming years. - Role of Domestic and Foreign Investment:

India’s growing middle class, increasing consumption, and rising levels of foreign investment continue to drive stock market values. The 115% ratio reflects an economy that is on an upward trajectory and signals the attractiveness of the market for both domestic and international investors, but also indicates that investors should remain cautious about any potential overvaluation.

Limitations of the Market Cap-to-GDP Ratio for India

While the Market Cap-to-GDP ratio provides a quick snapshot, it has its limitations, especially when applied to emerging markets like India:

- Stock Market Depth:

India’s stock market is still developing, and not all sectors of the economy are equally represented. For example, the agriculture and unorganized sectors contribute significantly to GDP but have limited representation in the stock market. Therefore, the ratio may not fully capture the true economic size and could give a skewed picture. - Technological and Digital Economy:

India’s tech sector, particularly in areas like IT, e-commerce, and fintech, is growing rapidly. These sectors often have high market valuations relative to their current contribution to GDP. This can make the market cap look inflated compared to the size of the traditional economy. - External Factors:

The Indian market is heavily influenced by global economic conditions, such as foreign investment flows, currency fluctuations, and global commodity prices. These external factors can sometimes lead to disproportionate movements in the ratio, which may not always reflect domestic economic fundamentals.

What Should Investors Take Away?

For investors, the Market Cap-to-GDP ratio serves as a valuable tool for assessing whether the stock market is overvalued or undervalued. However, it should not be used in isolation. Investors should consider other metrics such as price-to-earnings (P/E) ratios, corporate earnings growth, inflation rates, and economic policies when making investment decisions.

India’s current Market Cap-to-GDP ratio of around 115% suggests that the market is slightly overvalued relative to its economy, but the underlying growth prospects of the country—driven by technology, consumption, and infrastructure development—offer strong justification for this valuation. Investors should carefully monitor the ratio over time as it could signal market corrections or future growth opportunities.

Conclusion

The Market Cap-to-GDP ratio is a powerful tool for gauging the valuation of a country’s stock market relative to its economy. For India, a ratio around 115% signals that the stock market is slightly overvalued, but still in line with the country’s long-term economic growth potential. As India continues to expand and attract investment, understanding this ratio and its implications will help investors make more informed decisions.